Insurtech, Chat-bots, AI, Oh My!

Why insurtech is the problem and the solution.

Every time I go to Insurance Journal or LinkedIn, I see the same buzz-words: Insurtech, Artificial Intelligence, Chat Bots, etc. Every day there is a merger, buy-out, acquisition involving another insurance industry disruptor.

It is obvious our industry in at the cusp of a digital and technological transformation. In fact, Servion Global Solutions believes 95% of all customer interactions will involve an AI experience, including live phone and online engagements, by 2025.

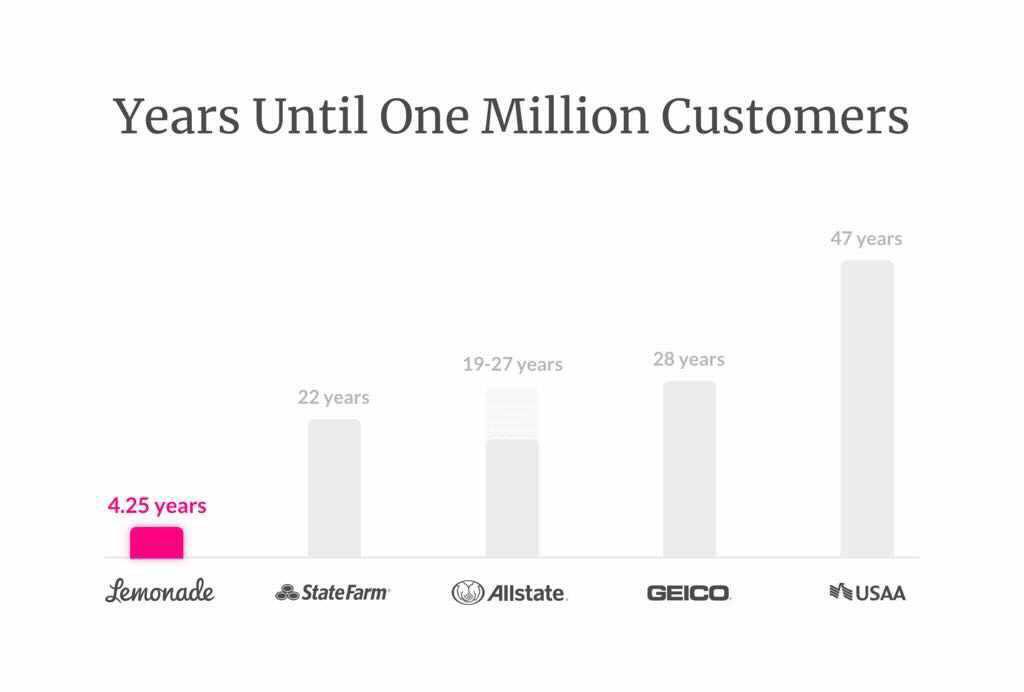

It’s been fun watching the new Insurtech startups and the early tech adaptors make big moves in our space. Some have experienced strong successes, such as Lemonade, who recently reached one million policies in 4.25 years, five to ten times faster than the incumbents. Granted, for every Lemonade that finds success, there are many failed startups fading away each year.

It’s been fun watching the new Insurtech startups and the early tech adaptors make big moves in our space. Some have experienced strong successes, such as Lemonade, who recently reached one million policies in 4.25 years, five to ten times faster than the incumbents. Granted, for every Lemonade that finds success, there are many failed startups fading away each year.

The tech-success stories are becoming more widely found by way of strategic investments and partnership arrangements. However, compared to the industry as a whole, early adaptors make up a minority of P&C carriers. The majority of carriers are either maintaining status quo or just barely dabbling in digital interfaces. Many insurance leaders and stakeholders are risk adverse (its kind of the point of insurance, right?). Research from McKinsey shows only 16% of U.S Insurer leaders have the appetite for risk-taking and creativity found in the tech-forward leaders in other industries. So, what’s the problem? Risk adversity and slow innovation have not stopped most carriers from making steady profits for decades.

The problem is the millennials are coming, 72.1 million of them, and they want more from their insurance experience. According to a white paper published by agent for the future, 80% of millennials own a car, 45% own a home and 78% plan to own a home in the next 9 years. The white paper surveyed a sample size of 1,600 millennials and found the two most important factors for customer loyalty is ease of use and an understanding of the insurance process.

So why aren’t carriers jumping in feet first? In most cases, their own IT is in the way. According to McKinsey, nine in ten carriers state their biggest barrier to digital transformation is the size or complexity of their legacy IT systems and the enormous cost to overhaul such a vast system. How can P&C carriers balance the needs of the upcoming tsunami of insureds who will buy with companies like Lemonade and Hippo who speak to their digitally-focused needs?

The solution lies in partnerships. The agile nature of mid-sized service partners in the agent and claims space allows quick adaption to customer engagement tools which can be implemented much faster and cheaper than remodeling a legacy IT system. Service providers should be actively engaging in technological innovation projects to bring more to the table for the clients they serve. The regional mutual company should have the same opportunity and access to digital and tech customer engagement tools as the large, venture capital backed insurance companies. Partnering with providers who can offer the solution on your behalf will improve the competitive advantage of smaller companies while bridging the gap between the barriers experienced by insurance companies and the needs of the evolving policyholder.

In 2017, Brush Country Claims saw the writing on the wall. We set forth to become a more agile business by making the necessary investments to ensure our relevance in the future of this industry. We began the heavy lift of building our own proprietary suite of software solutions tailored to the ideal claims process. The focus of our technology, processes, and programs is centered around customer experience and driven by the correct blend of technological innovations and human touch. If you are a carrier that feels that you may be missing some pieces to the innovation puzzle, we would love to discuss the unique solutions available to meet your specific goals and the demands of your policyholder. Please contact us regarding our strategic discovery process to determine if Brush Country Claims is the ideal partner for you.

Graphic courtesy of Business Wire

This article was written by Troy Stewart, President and Chief Operating Officer of Brush Country Claims.

Click here to view more of Troy’s content on LinkedIn

About Brush Country Claims

Brush Country Claims is an independent adjusting firm that offers a full claims solution for residential, commercial, daily, and catastrophe claim management. Brush Country utilizes an innovative suite of proprietary technology to maximize customer experience while consistently having some of the fastest cycle times in the industry. A human led, tech forward approach embraces the grassroots beginnings of the company as well as their incredible drive to propel into the future.

Related Posts

July 28, 2021

PRESS RELEASE: Lloyd’s Lab Pitch Day

GEORGETOWN, Texas – July 28, 2021 – Brush Country Claims, a Central Texas-based…

July 12, 2021

Get to Know our CAT Team Leaders

With hurricane season upon us, we wanted to do a little Q&A with our CAT team…

June 24, 2021

The Benefits of Remote Work

Healthy culture = healthy employees. We’re proud to say our team at Brush…